The purpose of a carbon tax is to reduce fossil fuel usage due to the negative impacts it has on our climate. Imposing carbon taxes will encourage companies to manufacture and produce goods in a more efficient manner by using alternative sources of energy.

When companies are required to pay a carbon tax, they will be more aware of the emissions they generate. If they depend less on oil and fuel, they may turn to green sources when producing energy. Imagine cars being fueled using environment-friendly ideas such as electricity and hydrogen fuels.

There is a need for synthesizing ideas that help us generate electricity from alternative sources which are both eco-friendly and sustainable. Another benefit of the carbon tax is that it has the potential to enhance revenue significantly, which perhaps can also provide additional funds to produce green electricity.

Green energy is a form of energy that comes from sources like wind, sunlight and rain. Green electricity is eco-friendly, more sustainable and can provide immense benefit to communities in both urban and rural areas. Carbon tax also has the potential to prevent further damage caused by pollution and carbon dioxide on the environment.

While it is thought to be a great idea for some provinces, it can be bad news for others. Saskatchewan has pushed the narrative that the province will be impacted negatively by carbon tax, but the experts in the field are not so sure about the validity of this statement.

Still, the Saskatchewan government holds firm to its belief.

According to Environment Minister Dustin Duncan, “The federal government has significantly underestimated the economic impact of its carbon tax and overestimated the expected greenhouse gas reductions.” In the media release from 2018, Duncan suggested that a decreased GDP results in non-competitive industries and fewer jobs across the province.

This perceived decline in job opportunities is the main reason why the Government of Saskatchewan is not pleased with a carbon tax. However, in an interview with The Canadian Press, Trade Minister Jeremy Harrison said that we will be unable to make a direct link between carbon tax and job loss.

There appears to be studies with conflicting outcomes, signaling that it may be too early to measure the actual impact of the tax.

In addition to significant impacts on provincial and national GDP, a 2018 study from the University of Calgary suggests that an average Saskatchewan household would have to pay more than $1,000 each year for the carbon tax. Yet, in an article released by Global News in 2019, the average household cost was found to be much less than originally projected, with Saskatchewan residents paying roughly $400.

Saskatchewan’s provincial parties are opposed to the Liberal party’s carbon tax, with Premiere Scott Moe still rallying against the plan. Efforts have been made to change Prime Minister Justin Trudeau’s stance on the topic, even after the law has come into effect. Seven months later, Moe continues to challenge the carbon tax in court, maintaining that it is ineffective.

Saskatchewan is also concerned about the tax’s impact on the agricultural sector. What about the farmers who have not managed to finish their harvest or are perhaps dealing with wet crops?

The added carbon tax can be very stressful on top of a bad harvest season. It is not realistic for farmers to pay extravagant amount of tax for drying the grain. In the past, Ryan Meili, Saskatchewan opposition leader, had even asked the PM for the removal of extra charges that farmers have been racking up on in their energy bills.

According to Dustin Duncan, the current carbon tax plan does not consider the requirements of industries that play a big role in driving our economy. He suggests a new plan that reduces emissions but also ensures that Saskatchewan industries remain competitive, further preserving the jobs of many Canadians.

While the federal government claimed in April that Canadians would receive more from the tax rebate than they would pay into the carbon tax, it may be too early into the program to effectively assess these figures.

In December 2019, the federal government decreased the carbon tax rebate in Saskatchewan and two other provinces who have not met federal requirements. Duncan expressed his disappointment and lack of surprise regarding the decrease.

While environmentalists consider it as a great opportunity to reduce pollution, companies consider it as a bane impacting the country’s economy. As Saskatchewan continues its legal journey of understanding the best ways to implement a carbon tax, the goal is to reduce the carbon pollution while minimally affecting the day-to-day lives of the residents of the province.

—

Sakshi Goyal

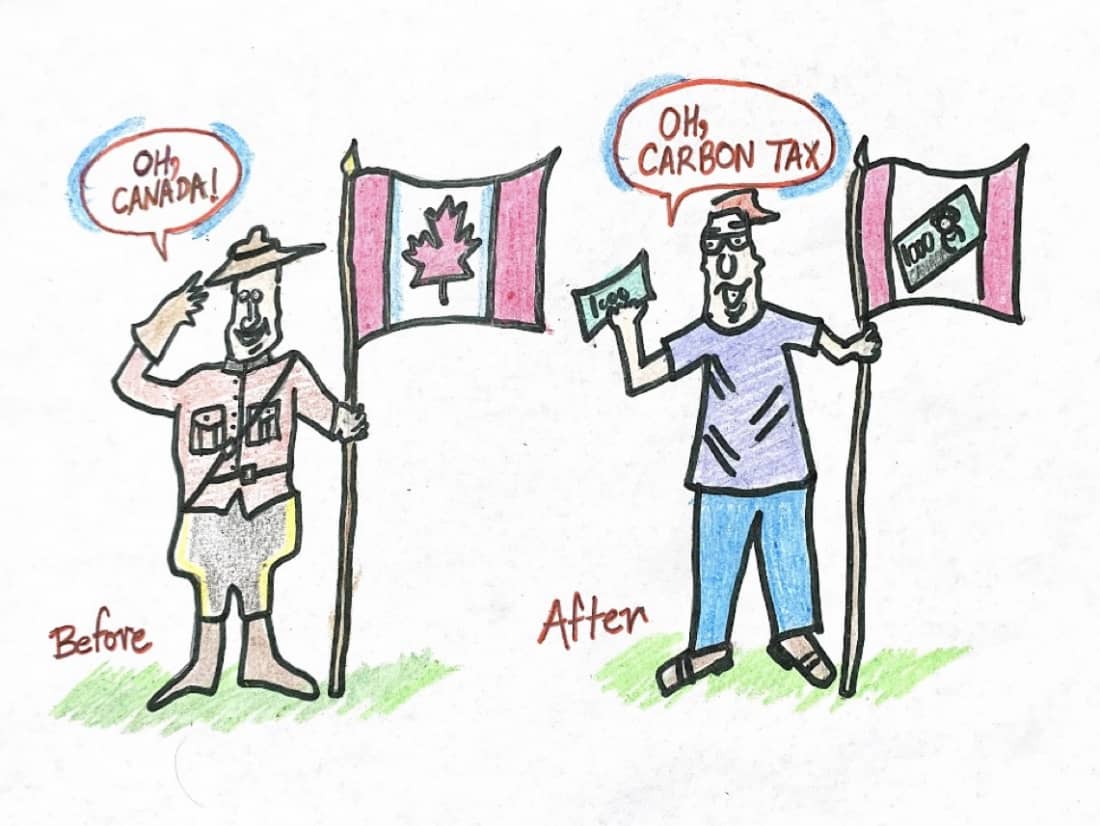

Graphic: Sakshi Goyal

Leave a Reply